Closing summary

Time to recap, after a busy day in which the UK central bank unleashed its most forceful act to tame inflation for 30 years.

Homeowners are facing the biggest single shock on their mortgage bills since the 1980s as the Bank of England hiked interest rates for the eighth time in a row.

But the UK’s central bank has also tried to calm fears that interest rates could hit 5%, warning that this would trigger a very painful two-year recession.

The Bank’s base rate has been lifted to 3% from 2.25%, its highest for 14 years, which will add around £3,000 per year on to mortgage bills for those households that are set to renew their mortgages, on average.

More than two million people on variable rate mortgages will suffer an immediate hit, while approximately 1.8 million households whose mortgages are up for renewal next year face a jump in their repayments too.

Bank governor Andrew Bailey defended hitting households with higher borrowing costs. He warned that inflation was too high, and would cause more pain if it wasn’t brought down.

He told reporters:

“If we do not act forcefully now it will be worse later on.”

And the Bank also pushed back against recent market expectations that interest rates could hit 5.25% next year.

Bailey explained:

“We can’t make promises about future interest rates but based on where we stand today, we think Bank Rate will have to go up by less than currently priced in financial markets.”

Its latest economic forecasts showed that hiking that high would push the UK into the longest downturn in modern history – a two-year contraction.

But if rates stayed at 3% the recession would last five quarters – which will still be a heavy blow to many households and firms.

The good news - if interest rates don't rise as high as markets expect & stay at 3% the Bank of England projects a shallower recession (red line vs blue line).

— Ben Chu (@BenChu_) November 3, 2022

The bad news - even *that* would leave the level of UK GDP *still* below its peak this year in Autumn *2025* 👇 pic.twitter.com/pzy5nQCpui

In both scenarios, UK inflation falls back from its current double-digit levels and undershoots its target towards the end of the forecast period – a sign that the Bank doesn’t anticipate hiking rates as high as 5%.

...Bank sending a clear signal interest rates don't need to rise as high as markets pricing in.

— Ben Chu (@BenChu_) November 3, 2022

This projection shows inflation if rates hit 5.17% (blue line) vs rate staying at 3% (red line)

In *both* scenarios inflation seen falling below the 2% target in 2025 👇 pic.twitter.com/NiN4uIdrft

Two of the Bank’s nine rate-setting policymakers, Silvana Tenreyro and Swati Dhingra voted against the hike, favouring smaller increases in borrowing costs, given the UK’s economic plight.

Tenreyro, who only wanted a 25-basis point rise, pointed out that monetary policy had already been restrictive in light of falling real incomes, with the economy now likely to be entering recession.

In a gloomy warning, governor Bailey said the turmoil hitting the UK is worse in economic terms than what hit in the 1970s, due to the Ukraine war and supply chain disruption following the pandemic.

“This is a huge shock.”

“If you compare this to the 1970s, and you compare this year to single years in the 1970s, and also government policies comes into play there in terms of energy markets. This is a bigger shock than in any year in the 1970s.”

And Bailey signalled that mortgage rates should come down, as the markets adjusted:

We can make no promises about future interest rates.

But based on where we stand today, we think [rates] will have to go up by less than currently priced into financial markets. That is important because, for instance, it means that the rates on new fixed-term mortgages should not need to rise as they have done.”

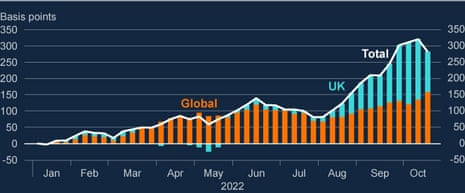

The Bank also showed how political upheaval had pushed up UK borrowing costs:

New Bank of England chart shows how UK factors - including the Truss/Kwarteng mini budget - have driven up the cost of government borrowing. pic.twitter.com/TK2FCZY1Ho

— Georgina Lee (@lee_georgina) November 3, 2022

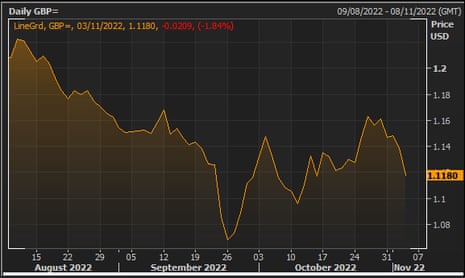

The pound fell sharply as traders digested Bailey’s words. Sterling has shed over two cents against the dollar to $1.118, with one investment manager warning the pound is trapped in a ‘currency doom loop’.

Chancellor Jeremy Hunt admitted that the rise would be very tough for families with mortgages and businesses with loans, and warned of ‘difficult decisions’ ahead:

“The most important thing the British Government can do right now is to restore stability, sort out our public finances, and get debt falling so that interest rate rises are kept as low as possible.

“However, there are no easy options and we will need to take difficult decisions on tax and spending to get there.”

His Labour counterpart, Rachel Reeves, said PM Rishi Sunak should face up to the mistakes that have left the UK in a “vicious cycle of stagnation”.

“Families now face higher mortgages and more anxiety after months of economic chaos.

“Today’s recession warning lays bare how 12 years of Tory government has weakened the foundations of our economy, and left us exposed to shocks, lurching from crisis to crisis with falling living standards and low growth.

The Resolution Foundation said over five million households are set to see their monthly mortgage bills increase sharply over the next two years, by an average of around £3,900.

Citizens Advice urging banks to show understanding to anyone struggling with loan repayments, and to reach out in case customers need help, but are too worried to ask.

Morgan Wild, head of policy at Citizens Advice, says:

“Right now, people are facing a double whammy of soaring interest rates and sky-high inflation.

Economists warned that lifting interest rates so sharply, in an effort to lower inflation, are worsening the near-term economic outlook.

Melanie Baker, senior economist at Royal London Asset Management, explained:

“Despite another set of grim forecasts for the real economy, including for the unemployment rate, they hiked 75bp today. It is clear that their focus remains inflation.

Here’s our latest news story on the Bank’s decision:

Analysis from our economics editor Larry Elliott:

And an explanation about how higher rates will affect you: